Welcome to LZN's Blog!

Wind extinguishes a candle but energizes fire.-

Scratch Notes for Stanford CS107: Programming Paradigm Ch03

L3: Converting Between Types of Different Sizes and Bit Representations Using Pointers

Notes

Forced Type Conversion

double d=3.1416; char ch=*(char *)&d; // 1. &d get d ref --> 2. (char *) use char point to &d --> 3. * deref by `char`Another dangerous test:

short s=45; double d=*(double *) &s;Note

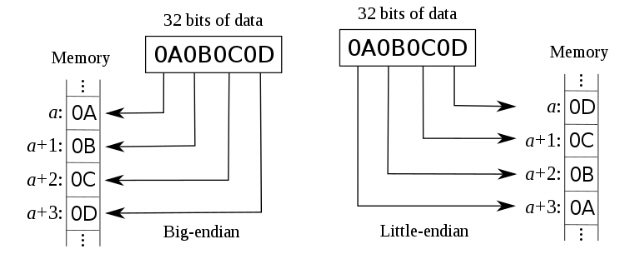

doubleneed 8 bytes to store the value, while short only takes 2 bytes, so this operation is very dangerious.Big Endian and Little Endian:

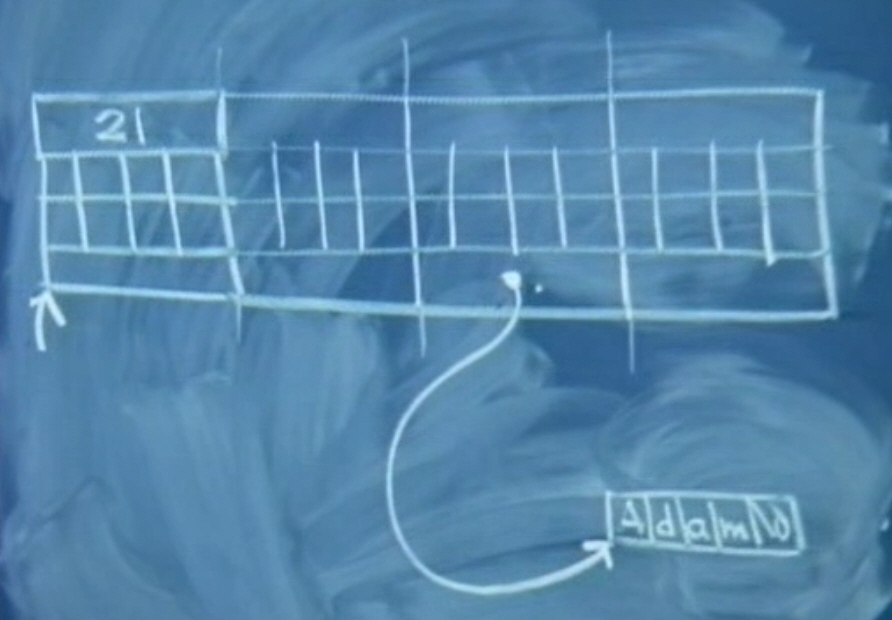

See this plot:

If copy a

shorttype 1 from Big Endian machine to Little Endian machine, it will give a 256. Not a problem in forced type conversion.Struct

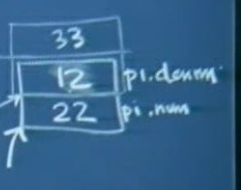

struct fraction{ int num; int denum; }; fraction pi;pattern:

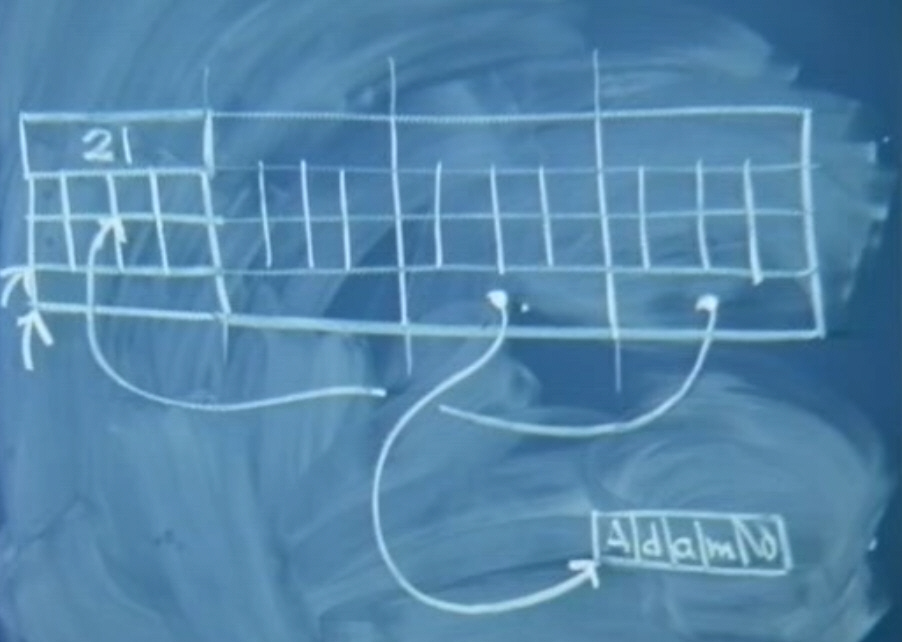

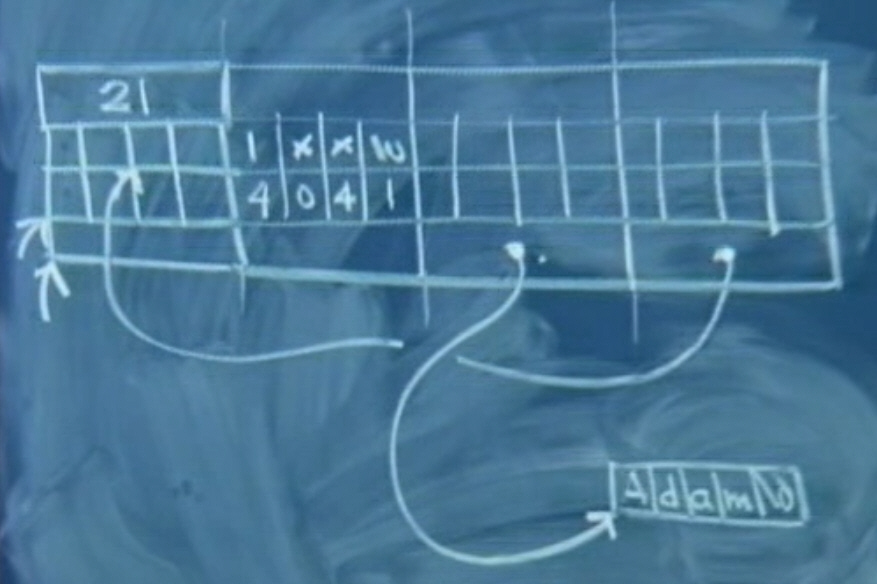

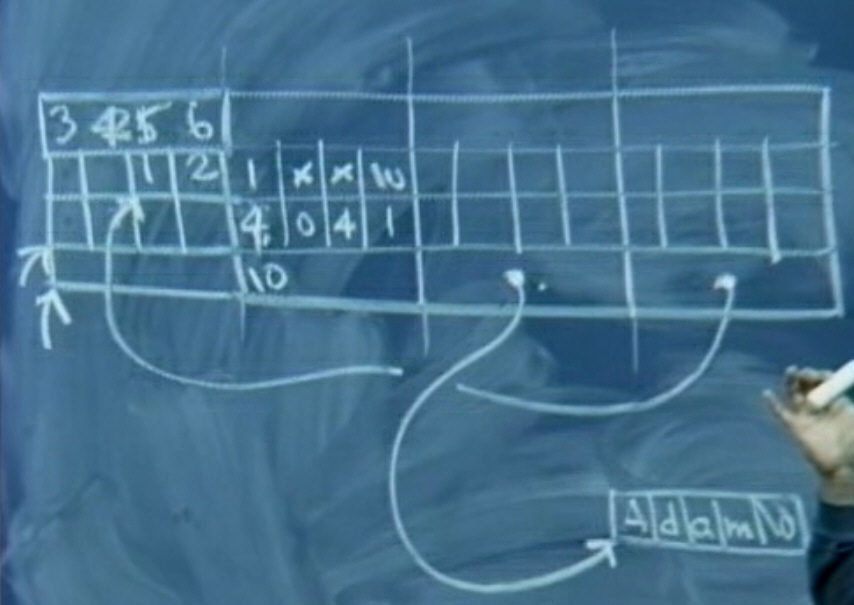

||||pi.denum ||||pi.num ^ | pointerSee the quirky syntax:

(fraction*)(&pi.denum))->num=12;It first point to the original

pi.denum(4 byte) and then interpret it to a fraction struct! What will happen? The orginalpi.denumis interpreted to a<new_struct>of fraction! Thus,->num=12 will change the original `pi.denum` value! Similar examples:

((fraction*)&(pi.denum))->denum=33;What you will see:

Array

Actually, we need to accept the concept that verything in C/C++ is pointer, look at array:

array<=>&array[0] array+k<=>&array[k] *array<=>array[0] *(array+k)<=>array[k]If do this:

int array[10]; array[10]=1;Be aware, this will not cause a compiler error as the C compiler is an efficiency-wise compiler, it will not do the bounce check. array[10] will be interpreted by 10*sizeof(a[0]), which is 40. Thus, from

&array[0]and count for 40 bytes, that 4-byte space will be set to 1. This operation even tolerates negative numbers. (This is just code, not good code!) The neighbouring address is highly possible to be other variables. See activation record.The above code is equivalent to:

*(array+10)=1;There could be many crazy examples (Actually there is an error, you can find it):

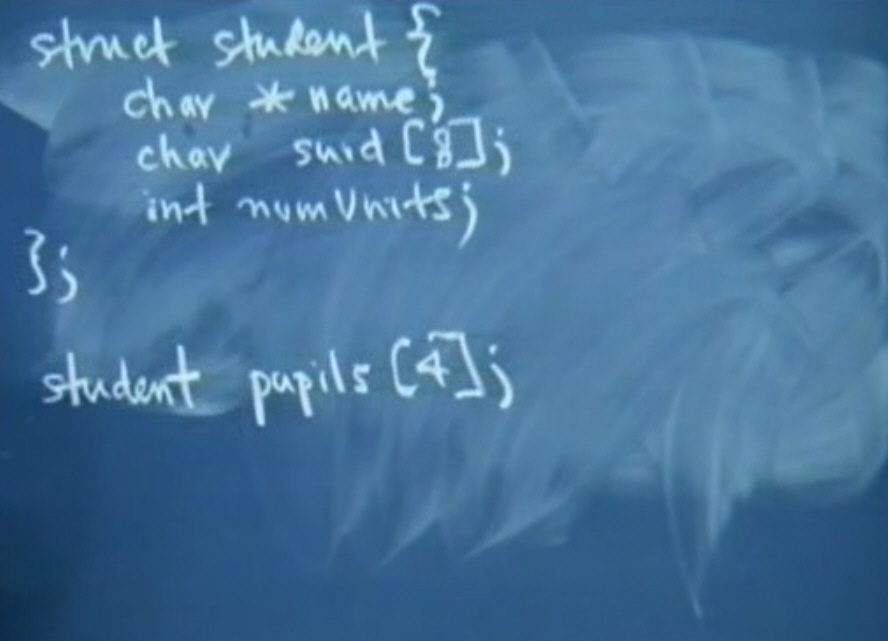

Struct Array

Now we see the

struct:

The corresponding bit patterns in memory: KCwj.jpg](https://s1.ax1x.com/2020/08/06/aRKCwj.jpg)

Try this:

pupils[2].name=strdup("Adam");Here a

linked tablelike thing will work:

And this:

pupils[3].name=pupils[0].suid+6;You will see:

Another one:

strcpy(pupils[1].suid, "40415xx");

Null character

\0orNULTry a scary on:

strcpy(pupils[3].name,"123456")See the result:

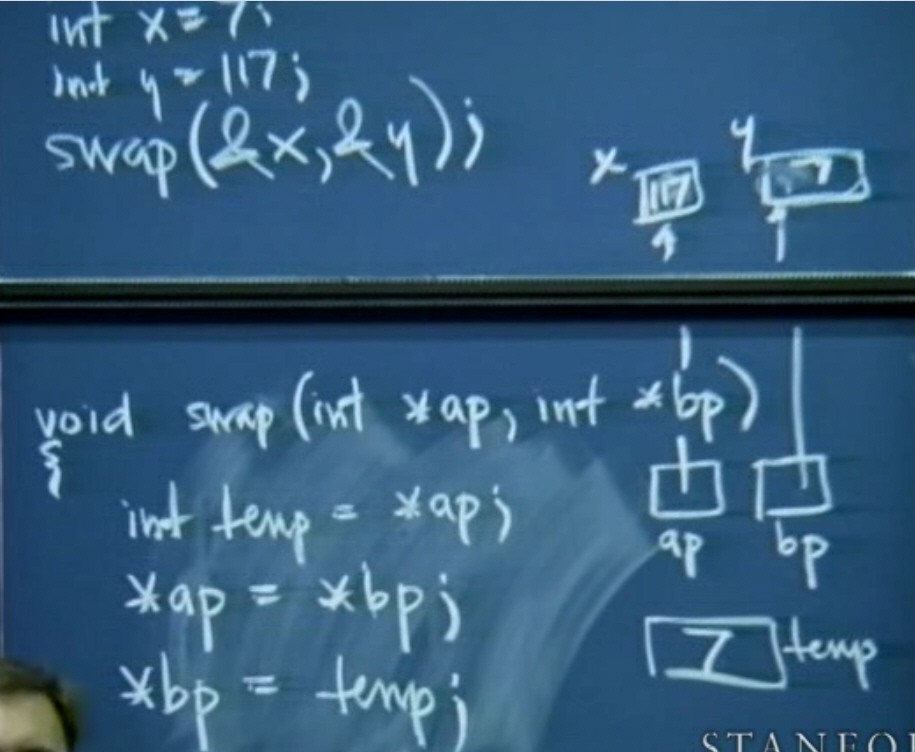

Generic Swap Important

void swap (int *ap, int *bp) { int temp = *ap; *ap = *bp; *bp = temp; } int x=7; int y=117; swap(&7, &y);See the flow:

Qustions

Glossary

Asterisk 星号 Ampersand 连i字符 synonymous 同义的 arithmetic 算数的 verbatim 逐字的 backslash 反斜线 jurisdiction 管辖权 two to the ninth 2^9 gibberish 胡言乱语 contrived (deliberately created rather than arising naturally or spontaneously) phantom 幻影Updated 2020-08-06

-

Start to Build SCREAM onto CUHK Cluster

Old version test

Newly updated SCREAM repo removed the readme file about how to port the code, but the older version of readme can be fetched by tracing back the code histroy.

The first problem comes from buiding kokkos:

CMake Error at cmake/kokkos_functions.cmake:64 (MESSAGE): Matching option found for Kokkos_ENABLE_SERIAL with the wrong case KOKKOS_ENABLE_SERIAL. Please delete your CMakeCache.txt and change option to -DKokkos_ENABLE_SERIAL=ON. This is now enforced to avoid hard-to-debug CMake cache inconsistencies.This error is basically hoping you use camel-like cases in the command line to set the configuring flags. Just follow it suggests.

The command changes to:

cmake \ -D CMAKE_INSTALL_PREFIX=${RUN_ROOT_DIR}/kokkos/install \ -D CMAKE_BUILD_TYPE=Debug \ -DKokkos_ENABLE_DEBUG=ON \ -DKokkos_ENABLE_AGGRESSIVE_VECTORIZATION=OFF \ -DKokkos_ENABLE_SERIAL=ON \ -DKokkos_ENABLE_OPENMP=ON \ -DKokkos_ENABLE_PROFILING=OFF \ -DKokkos_ENABLE_DEPRECATED_CODE=OFF \ -DKokkos_ENABLE_EXPLICIT_INSTANTIATION:BOOL=OFF \ ${KOKKOS_SRC_LOC}Here we can successfully install the Kokkos. In building the SCREAM, several errors appear:

CMake Error: File /users/b145872/project-dir/app/scream/components/scream/../cam/src/physics/rrtmgp/external/rrtmgp/data/rrtmgp-data-lw-g224-2018-12-04.nc does not exist. CMake Error: File /users/b145872/project-dir/app/scream/components/scream/../cam/src/physics/rrtmgp/external/rrtmgp/data/rrtmgp-data-sw-g224-2018-12-04.nc does not exist.This file can be easily download by a simple search. Here I just found something not right. It seems some modules are missing in the scream folder. I found they locate in the

externalfolder, and we can see the folder structure on github, but has not been cloned to local path.That is interesting! I then found these folders on github actually point to other repos. It is

[git submodule](https://git-scm.com/book/en/v2/Git-Tools-Submodules)!The right way to clone the repo with submodules:

git clone --recurse-submodulesNow it comes to the MPI issue (cannot find

mpi.h). Add INCLUDE path to.bashrc.export CPLUS_INCLUDE_PATH=$INCLUDE export C_INCLUDE_PATH=$INCLUDENew error:

/users/b145872/project-dir/app/scream/components/scream/ekat/src/ekat/util/scream_arch.cpp(34): error: class "Kokkos::Serial" has no member "impl_is_initialized" ss << "ExecSpace initialized: " << (DefaultDevice::execution_space::impl_is_initialized() ? "yes" : "no") << "\n";We then found the Kokkos default settings are not what we want, Seriel is not acceptable.

-- Final kokkos settings variable: -- env;KOKKOS_CMAKE=yes;KOKKOS_SRC_PATH=/users/b145872/project-dir/app/scream/externals/kokkos;KOKKOS_PATH=/users/b145872/project-dir/app/scream/externals/kokkos;KOKKOS_INSTALL_PATH=/users/b145872/project-dir/app/scream_run/scream_test01/kokkos/install;KOKKOS_ARCH=None;KOKKOS_DEVICES=Serial;KOKKOS_DEBUG=no;KOKKOS_OPTIONS=disable_dualview_modify_check;KOKKOS_USE_TPLS=librtWe then re-source the

~/.bashrc. It seems the configure grep the MPI settings now, with OpenMP as the Parallel settings. New error in configuring SCREAM:CMake Error at /users/b145872/project-dir/app/scream/externals/kokkos/cmake/kokkos_functions.cmake:49 (MESSAGE): Matching option found for Kokkos_ENABLE_DEBUG with the wrong case Kokkos_ENABLE_Debug. Please delete your CMakeCache.txt and change option to -DKokkos_ENABLE_DEBUG=FALSE. This is now enforced to avoid hard-to-debug CMake cache inconsistencies.This is weird. In configuring Kokkos, we give excatly “-DKokkos_ENABLE_DEBUG=ON ", and in configuring SCREAM, there is no such option. Using grep, we found several “Debug” in

components/scream/ekat/cmake/Kokkos.cmake, after changing to “DEBUG”, we pass this point…New error [26%]:

/users/b145872/project-dir/app/scream/components/scream/ekat/src/ekat/scream_kokkos_meta.hpp(18): error: class "Kokkos::MemoryTraits<0U>" has no member "RandomAccess" value = ((View::traits::memory_traits::RandomAccess ? Kokkos::RandomAccess : 0) |According to kokkos programming guide, the

RandomAccessis a trait from CUDA. It seems we also have to build cuda for SCREAM? If this is true, the SCREAM is required to run on GPU nodes. Okay, just a simple test, let us first see what would happen if we build kokkos in seriel mode.The seriel mode shows similar errors. Besides, I noticed it seems all memory access operation including “Atomic Access” traits are missing, thus it may not be simply “need cuda” issues. Interesting.

When I used the latest kokkos from github, different errors occur when try “Seriel” and “OPENMP”. When only “Seriel” is turned on, MPI errors will occur in compiling SCREAM.

New Version Passed!

On Jul 20, I found a new version of master branch and following the new instructions in build.md, the test can be finished successfully.

When I turn on CUDA with cuda version 10.1, there are still problems.

-

Try the Community Development Tool on GitHub

Here we show an simple example about how to use community development commands in GitHub.

We need to first fork the community repo, then clone it to our local machine. On the local machine, we can create our own branch:

git checkout -b test-brchAfter modification:

git add . git commit -m "test-brch" git push origin test-brchNow we push the revised branch onto our remote GitHub repo. Go to that repo and change to the branch, submit the pull request to the original repo. Then the community admin will see our pull request.

If we hope to merge the branch locally:

git checkout master # checkout to master branch git merge test-brchNow it is safe to delete the test-brch branch.

git branch -d test-brchUpdated 2020-07-10

- 【酒后真言】AI工厂、物理智能:英伟达CEO黄仁勋与思科CEO Chuck Robbins炉边对话 | 中英文完整版精译

- 超级智能、顺从型AI、超人类主义、基督与超越:PayPal、Palantir联合创始人彼得·蒂尔2025年6月播客实录 | 中英文完整版精译(下篇)

- 技术停滞、回到未来、风险承担 | PayPal、Palantir联合创始人彼得·蒂尔2025年6月播客实录 | 中英文完整版精译 (上篇)

- 与外星人进行贸易,应该用什么货币?

- 2026年投资展望:Year of D——持盈保泰,因利制权

- R星创始人、《侠盗猎车手》与《荒野大镖客》创作者丹·豪瑟2025年11月播客实录 | 中英文完整版精译 Part3

- R星创始人、《侠盗猎车手》与《荒野大镖客》创作者丹·豪瑟2025年11月播客实录 | 中英文完整版精译 Part2

- R星创始人、《侠盗猎车手》与《荒野大镖客》创作者丹·豪瑟2025年11月播客实录 | 中英文完整版精译 Part1

- Existence Series (Part 1) | Eternal Recurrence: If your life ended right at this moment, would you choose to replay it?

- 存在篇(一) | 永恒轮回:如果,你的生命,终止于此时此刻,你会选择重播它么?